Tag: finance

-

Experts predict a 0.25% rate cut from the Bank of Canada on Jan 29 2025

As the new year begins, Canadians are eagerly anticipating the Bank of Canada’s (BoC) first interest rate announcement of 2025. Scheduled for January 29, this update is expected to reveal key insights into the central bank’s strategy to address ongoing economic challenges. Experts are already weighing in on what to expect. Reflecting on the Final…

-

Bank of Canada Cuts Interest Rates By 50bps to 3.25%: What It Means for Canada’s Housing Market

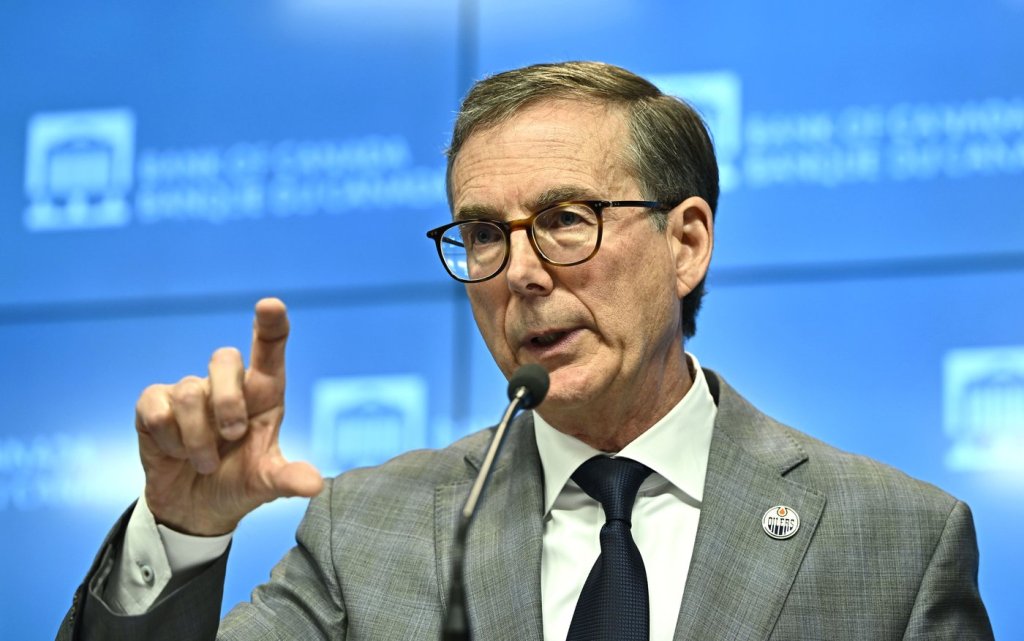

On December 11, 2024, the Bank of Canada made its second consecutive half-point rate cut, lowering the policy interest rate from 3.75% to 3.25%. This marks the fifth consecutive rate cut since June and signals a shift towards a more gradual approach to monetary easing. In a statement, Governor Tiff Macklem emphasized that while inflation…

-

Why Economists Are Changing Their Predictions: 50 Bps Rate Cut Likely from Bank of Canada Tomorrow

As the Bank of Canada prepares to announce its interest rate decision tomorrow, December 11, 2024, economists across the country are adjusting their predictions. Initially uncertain, many are now leaning towards a 50-basis-point (bps) rate cut, with top institutions like Scotiabank and the Bank of Montreal (BMO) joining the growing consensus. This decision could have…

-

Federal Government Announces Two-Month GST Holiday to Address Economic “Vibecession”

Canada’s federal government is rolling out a temporary GST holiday to address what Deputy Prime Minister and Minister of Finance Chrystia Freeland has called a “vibecession.” This two-month tax break aims to ease the financial strain on Canadians while boosting consumer confidence. Starting December 14, the goods and services tax (GST) will be removed from…

-

Canada’s Inflation Rate Rises to 2% in October, Lowering Likelihood for Large Rate Cuts

Canada’s inflation rate unexpectedly climbed back to 2.0% in October 2024, driven by a smaller decline in gasoline prices and rising grocery costs. This marks the first increase in the annual inflation rate since May, aligning with the Bank of Canada’s forecasts and curbing market expectations for a significant rate cut next month. The news…

-

What the Latest U.S. Federal Reserve Rate Cut Could Mean for Canadians

With the U.S. Federal Reserve cutting interest rates once again, Canadians may feel some ripple effects across various aspects of the economy. As the Fed’s policies impact the U.S. economy, Canada often experiences a spillover effect due to the close economic ties between the two countries. Here’s how this rate cut might influence Canadians in…

-

Don’t Rule Out a 75-Point Rate Cut: Bank of Canada Set for Big Decision

The Bank of Canada is set to make a major announcement on its overnight interest rate tomorrow, and most economists are predicting a significant cut. While a 50-basis-point reduction is the most likely outcome, some experts suggest that an even bigger cut—75 basis points—could be on the table. Could We See a 75-Basis-Point Cut? Avery…

-

Canadian Inflation Drops to 1.6% in September – A Big Rate Cut Might Be Coming

In September, Canada’s inflation rate dropped to 1.6%, the lowest it’s been since February 2021. This decrease is mainly due to falling gas prices and is raising hopes that the Bank of Canada will cut interest rates to help boost the economy. Many economists are now predicting that at the Bank of Canada’s next meeting…

-

Bank of Canada Lowers Key Interest Rate to 4.5%

The Bank of Canada announced a cut to its key interest rate this morning, reducing it by a quarter percentage point to 4.5%. This marks the second consecutive rate cut as the central bank responds to easing inflationary pressures and a weakening economic outlook. Bank of Canada Governor Tiff Macklem made the announcement during a…